A Recent Leveraged Buyout Was Financed With $50M - A recent leveraged buyout was financed with $50m. This amount comprised of partner's equity capital of $12m, $20m. A recent leveraged buyout was financed with $50m: $12m in equity capital, $20m unsecured debt borrowed at 7% from one bank, and the. A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m. This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and. A recent leveraged buyout was financed with $50m: This amount comprised partner's equity capital of $12m, $20m.

This amount comprised of partner's equity capital of $12m, $20m. $12m in equity capital, $20m unsecured debt borrowed at 7% from one bank, and the. A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m. A recent leveraged buyout was financed with $50m: This amount comprised partner's equity capital of $12m, $20m. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and. A recent leveraged buyout was financed with $50m. This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. A recent leveraged buyout was financed with $50m.

A recent leveraged buyout was financed with $50m. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and. This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. A recent leveraged buyout was financed with $50m: $12m in equity capital, $20m unsecured debt borrowed at 7% from one bank, and the. A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m: This amount comprised of partner's equity capital of $12m, $20m. $12m in equity capital, $20m in unsecured debt borrowed at 7. This amount comprised partner's equity capital of $12m, $20m.

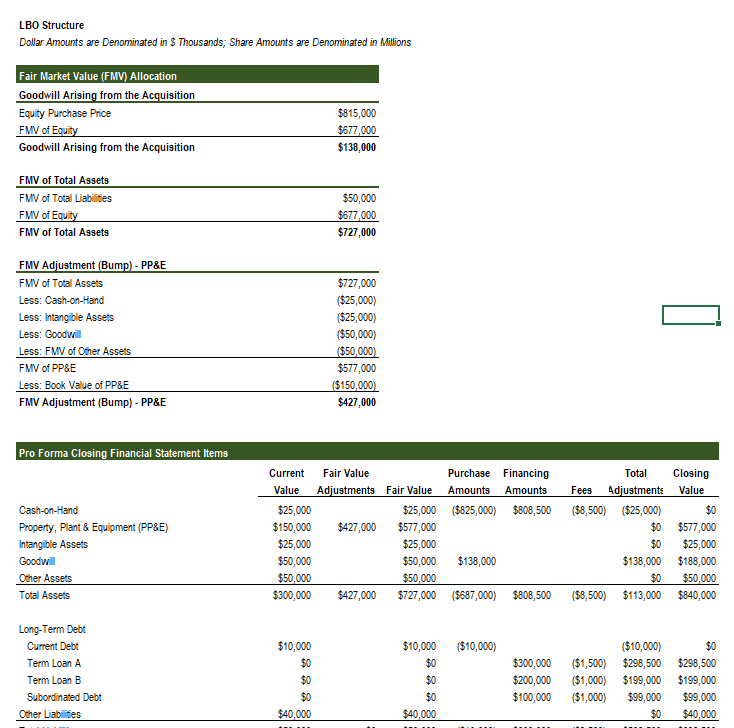

Solved A recent leveraged buyout was financed with 50M

A recent leveraged buyout was financed with $50m. A recent leveraged buyout was financed with $50m: $12m in equity capital, $20m in unsecured debt borrowed at 7. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and. A recent leveraged buyout was financed with $50m.

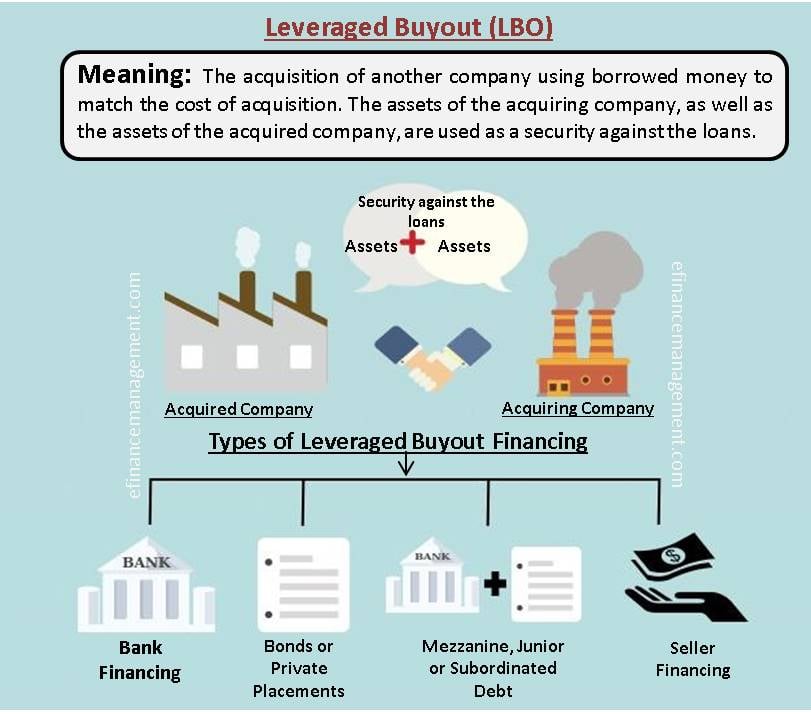

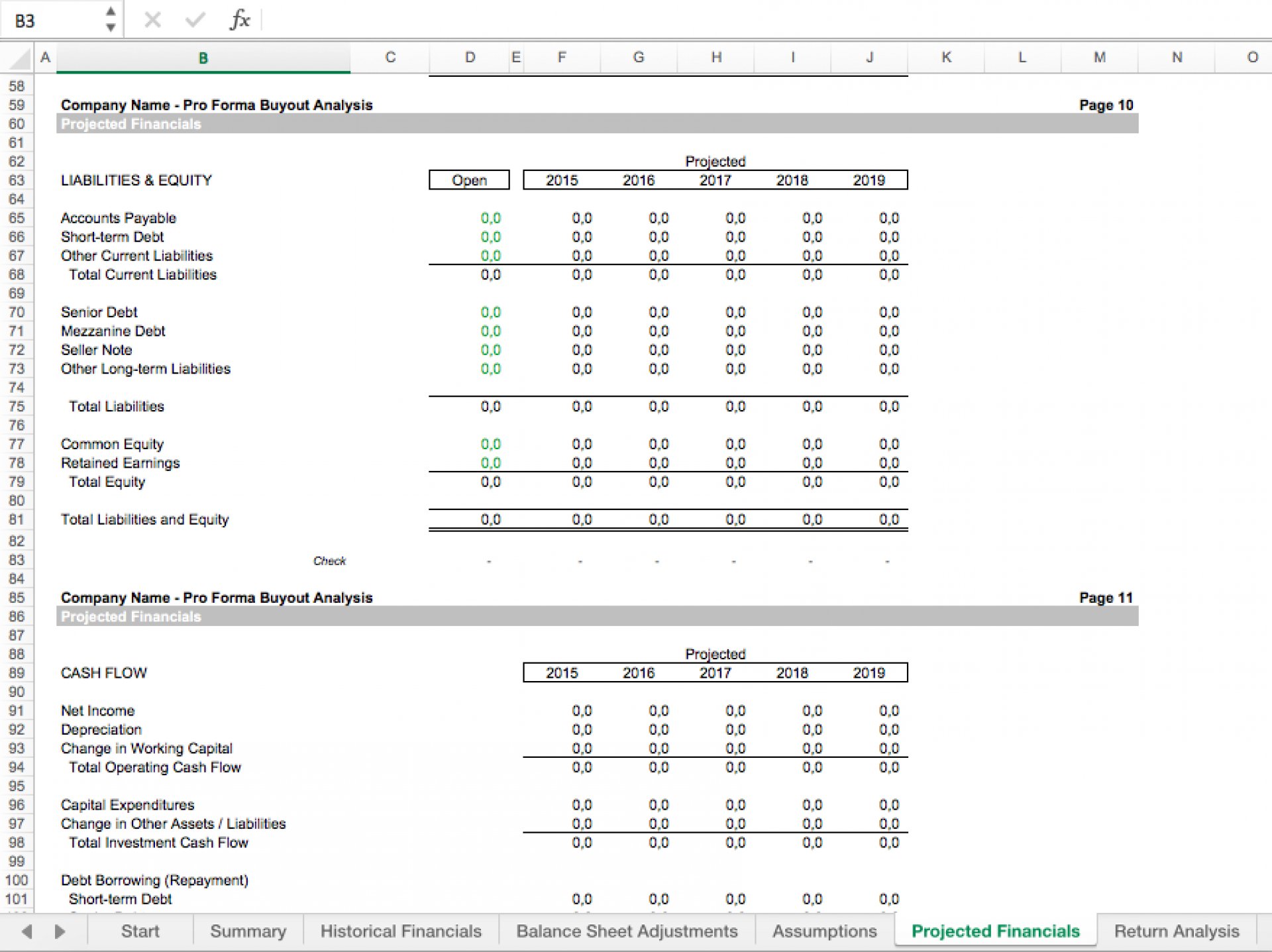

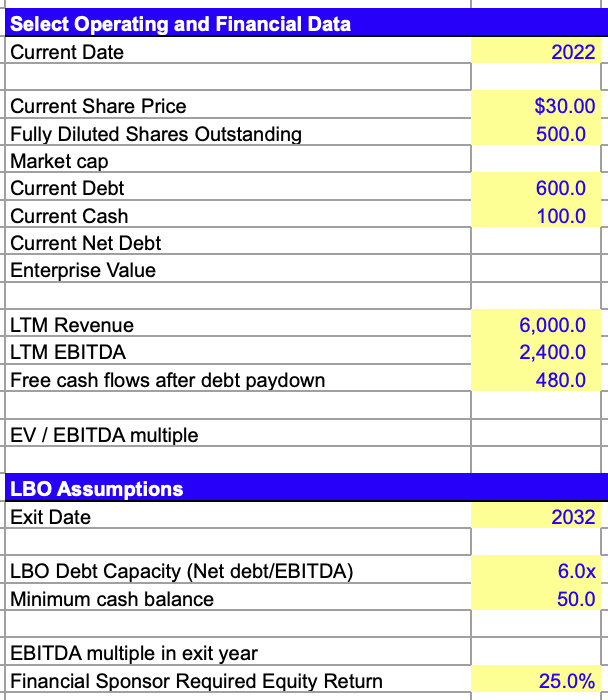

Leveraged Buyout (LBO) Financial Projection Model Eloquens

This amount comprised of partner's equity capital of $12m, $20m. A recent leveraged buyout was financed with $50m: This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. $12m in equity capital, $20m unsecured debt borrowed at 7% from one bank, and the. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank,.

Leveraged Buyout (LBO) Financial Model eFinancialModels

A recent leveraged buyout was financed with $50m. This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. A recent leveraged buyout was financed with $50m. This amount comprised of partner's equity capital of $12m, $20m. $12m in equity capital, $20m in unsecured debt borrowed at 7.

Financial Leverage Meaning, Measuring Ratios, Degree, Illustration eFM

A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m: This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and. A recent leveraged buyout was financed with $50m:

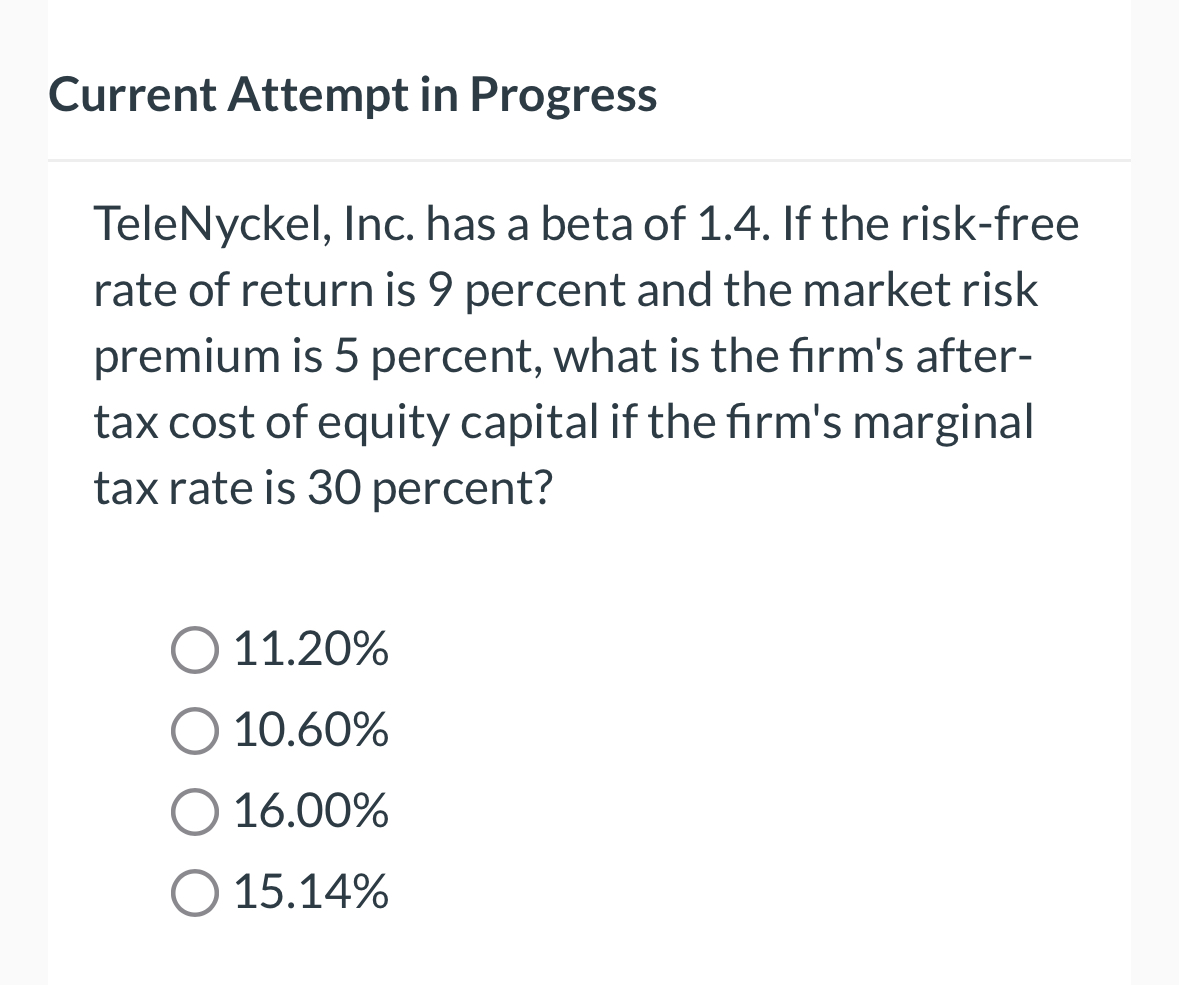

Leverage In Financial Management What is Leveraged Buyout ? LBO

This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m. A recent leveraged buyout was financed with $50m: $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and.

Detailed Leveraged Buyout (LBO) Financial Model Template and Overview

A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m. A recent leveraged buyout was financed with $50m. A recent leveraged buyout was financed with $50m: $12m in equity capital, $20m in unsecured debt borrowed at 7.

The Ultimate Guide to Leveraged Buyouts (LBOs) + Examples

$12m in equity capital, $20m in unsecured debt borrowed at 7. $12m in equity capital, $20m unsecured debt borrowed at 7% from one bank, and the. This amount comprised of partner's equity capital of $12m, $20m. This amount comprised partner's equity capital of $12m, $20m. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank,.

What Is a Leveraged Buyout?

A recent leveraged buyout was financed with $50m: This amount comprised of partner's equity capital of $12m, $20m. A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m. $12m in equity capital, $20m in unsecured debt borrowed at 7.

Leveraged Buyout Model for Private Equity Professionals Eloquens

A recent leveraged buyout was financed with $50m. A recent leveraged buyout was financed with $50m: $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and. A recent leveraged buyout was financed with $50m. A recent leveraged buyout was financed with $50m:

An Overview of the Leveraged Buyout (LBO) Financial Model

A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m: This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. A recent leveraged buyout was financed with $50m. $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and.

A Recent Leveraged Buyout Was Financed With $50M:

This amount comprised of partner's equity capital of $12m, $20m. This amount comprised of partner’s equity capital of $12m, $20m unsecured debt. A recent leveraged buyout was financed with $50m: A recent leveraged buyout was financed with $50m.

A Recent Leveraged Buyout Was Financed With $50M.

This amount comprised partner's equity capital of $12m, $20m. $12m in equity capital, $20m unsecured debt borrowed at 7% from one bank, and the. A recent leveraged buyout was financed with $50m: $12m in equity capital, $20m in unsecured debt borrowed at 7 percent from one bank, and.

A Recent Leveraged Buyout Was Financed With $50M.

$12m in equity capital, $20m in unsecured debt borrowed at 7.