I Recently Bought Propertyfor $1 How Much Expenses Is That - Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. “in total, our investment was $75,500. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. For example, on a $400,000 home, closing costs. We ended up selling this property. Additional minor updates and repairs cost about $3,000. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%.

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. “in total, our investment was $75,500. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. We ended up selling this property. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. For example, on a $400,000 home, closing costs. Additional minor updates and repairs cost about $3,000.

Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. For example, on a $400,000 home, closing costs. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. “in total, our investment was $75,500. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. We ended up selling this property. Additional minor updates and repairs cost about $3,000.

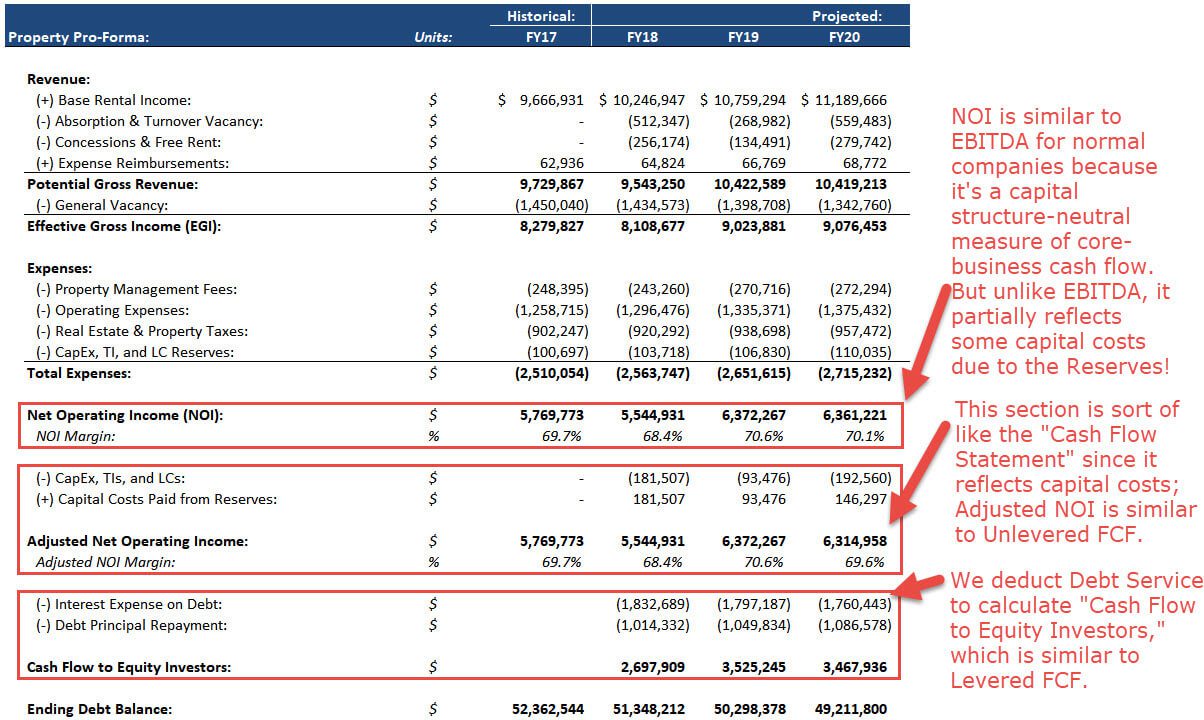

Real Estate ProForma Calculations, Examples, and Scenarios (Video)

For example, on a $400,000 home, closing costs. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. “in total, our investment was $75,500. The answer could make a big difference in how much you save—and it largely.

How to Easily Track Your Rental Property Expenses

Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. For example, on a $400,000 home, closing costs. We ended.

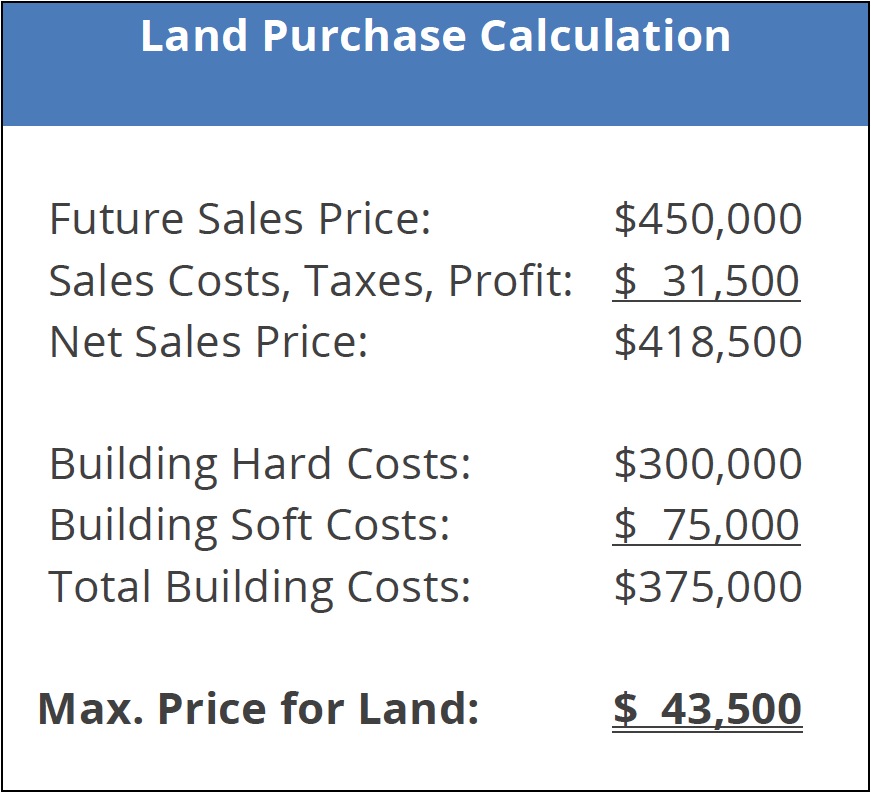

How much does it cost to build a house after buying land kobo building

For example, on a $400,000 home, closing costs. We ended up selling this property. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. The answer could make a big difference in how much you save—and it largely.

Post by Andy Buchanan Commonstock How Much Real Estate Could you

For example, on a $400,000 home, closing costs. Additional minor updates and repairs cost about $3,000. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. “in.

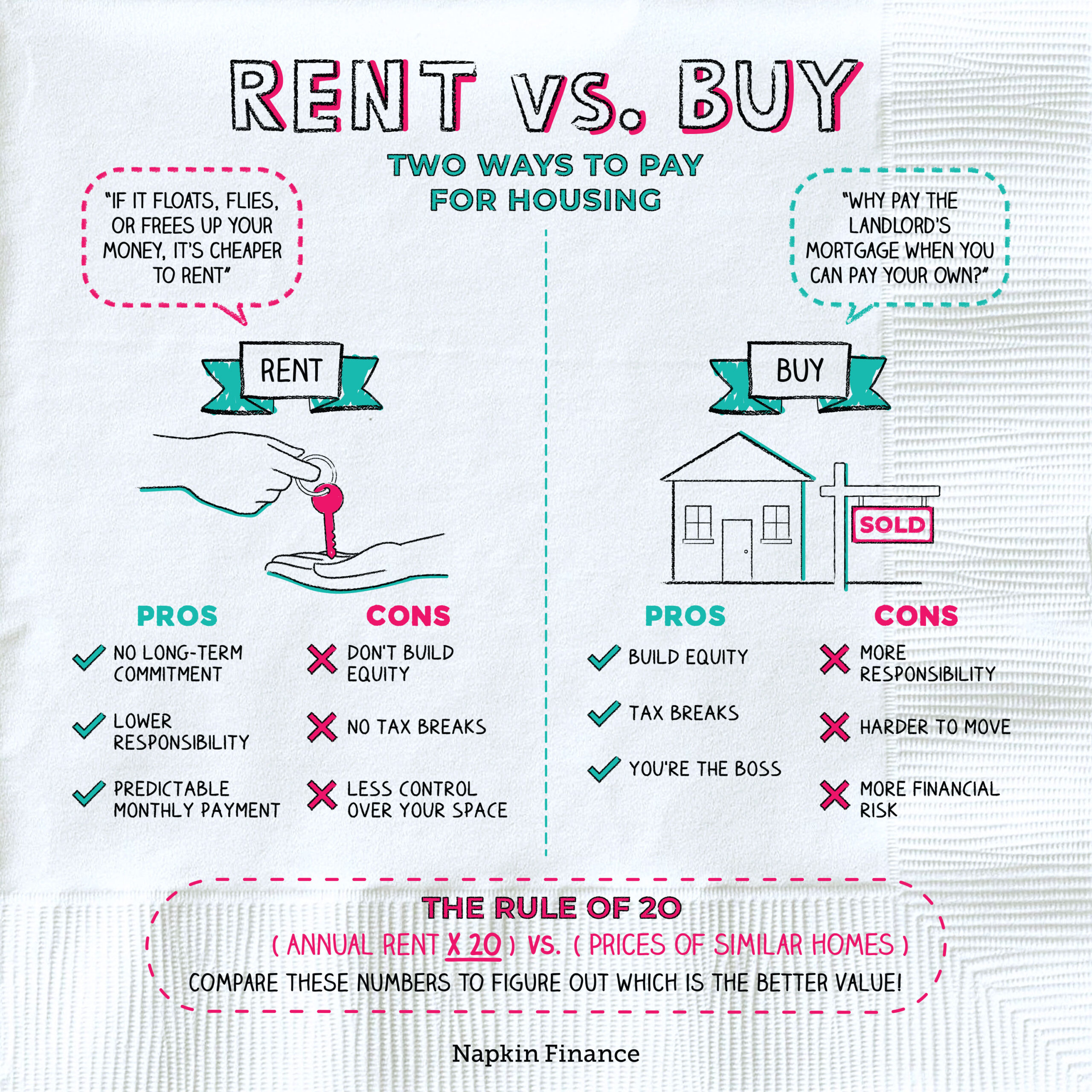

Should I Buy a House Rent vs. Buy Real Estate Buying vs Renting

Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. For example, on a $400,000 home, closing costs. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Closing costs.

How Much Money do you Need to Buy a Rental Property?

We ended up selling this property. For example, on a $400,000 home, closing costs. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. “in total, our.

How Much Money Do You Need To Buy A House? Bankrate

Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. For example, on a $400,000 home, closing costs. “in total, our investment was.

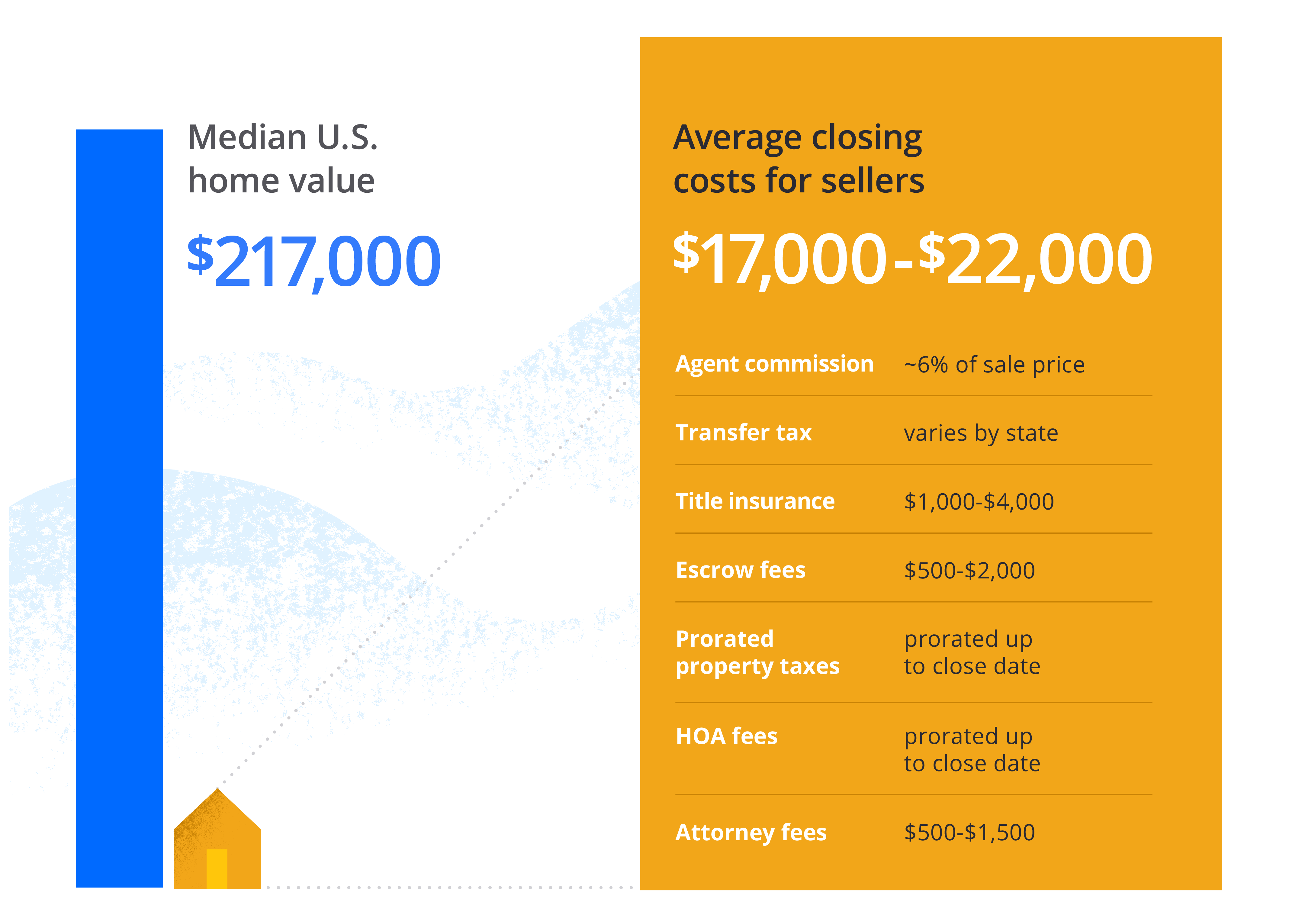

How Much Does it Cost to Sell a House? Zillow

“in total, our investment was $75,500. For example, on a $400,000 home, closing costs. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Additional minor updates and repairs cost about $3,000. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as.

[Solved] Last year, Eleanor and Felix Knight bought a home with a

For example, on a $400,000 home, closing costs. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required.

How Much Does It Cost To Buy A House Scotland at Katherine James blog

As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. We ended up selling this property. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. For example, on a $400,000 home, closing costs. “in total, our investment was $75,500.

“In Total, Our Investment Was $75,500.

Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%.

Closing Costs Typically Range Between 2% To 5% Of The Home’s Purchase Price For Buyers.

For example, on a $400,000 home, closing costs. We ended up selling this property. Additional minor updates and repairs cost about $3,000. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially.