Accounting For Stock Warrants - The accounting for warrants can either fall. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. How to account for stock warrants a business may pay a provider of goods or services with stock warrants. Warrants are considered written call options that meet the definition of a derivative. 4.5/5 (7,359) Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and.

The accounting for warrants can either fall. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. How to account for stock warrants a business may pay a provider of goods or services with stock warrants. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. Warrants are considered written call options that meet the definition of a derivative. 4.5/5 (7,359)

When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. How to account for stock warrants a business may pay a provider of goods or services with stock warrants. Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. Warrants are considered written call options that meet the definition of a derivative. The accounting for warrants can either fall. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. 4.5/5 (7,359)

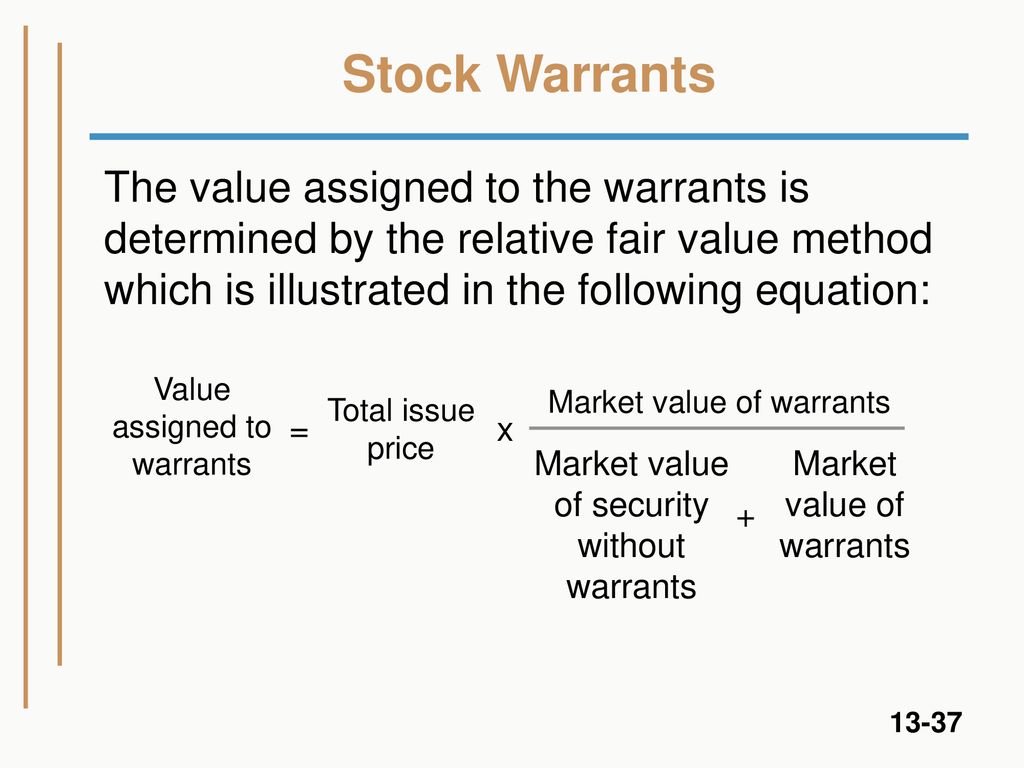

Intermediate Accounting ppt download

4.5/5 (7,359) Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. When the company sells stock warrant to the investors, they will receive cash and has the obligation to.

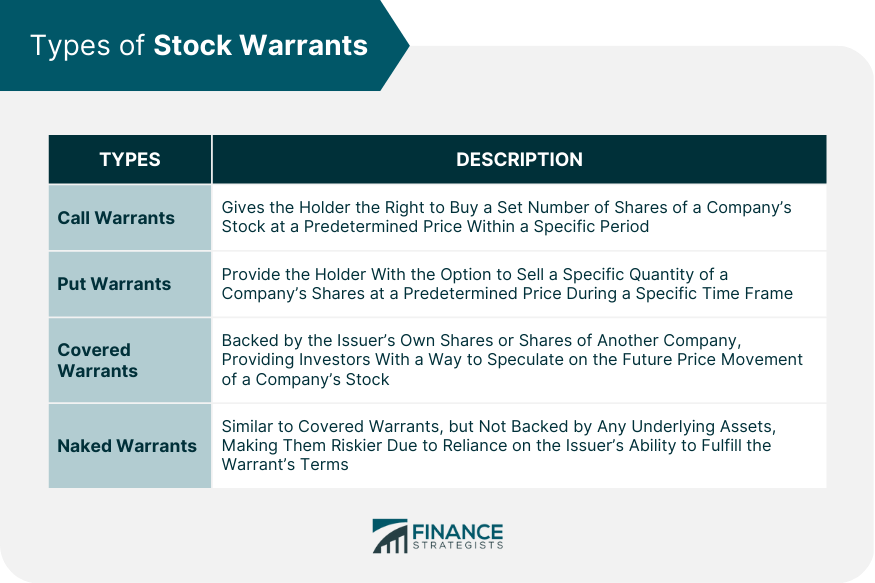

Stock Warrants Definition, How They Work, Types, Pros & Cons

How to account for stock warrants a business may pay a provider of goods or services with stock warrants. The accounting for warrants can either fall. 4.5/5 (7,359) When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. Warrants are considered written call options that.

Stock Warrants Definition, Types, Examples, Risks, & Benefits

4.5/5 (7,359) The accounting for warrants can either fall. Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. How to account for stock warrants a business may pay a provider of goods or services with stock warrants. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)).

Intermediate Accounting ppt download

4.5/5 (7,359) Warrants are considered written call options that meet the definition of a derivative. The accounting for warrants can either fall. How to account for stock warrants a business may pay a provider of goods or services with stock warrants. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled.

Intermediate Accounting James D. Stice Earl K. Stice ppt download

Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share.

Presenting Stock Warrants on a Balance Sheet Bizfluent

Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. How to account for stock warrants a business may pay a provider of goods.

Presenting Stock Warrants on a Balance Sheet Bizfluent

When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. How to account for stock warrants a business may pay a provider of goods or services with stock warrants. Warrants are considered written call options that meet the definition of a derivative. Understanding the accounting and.

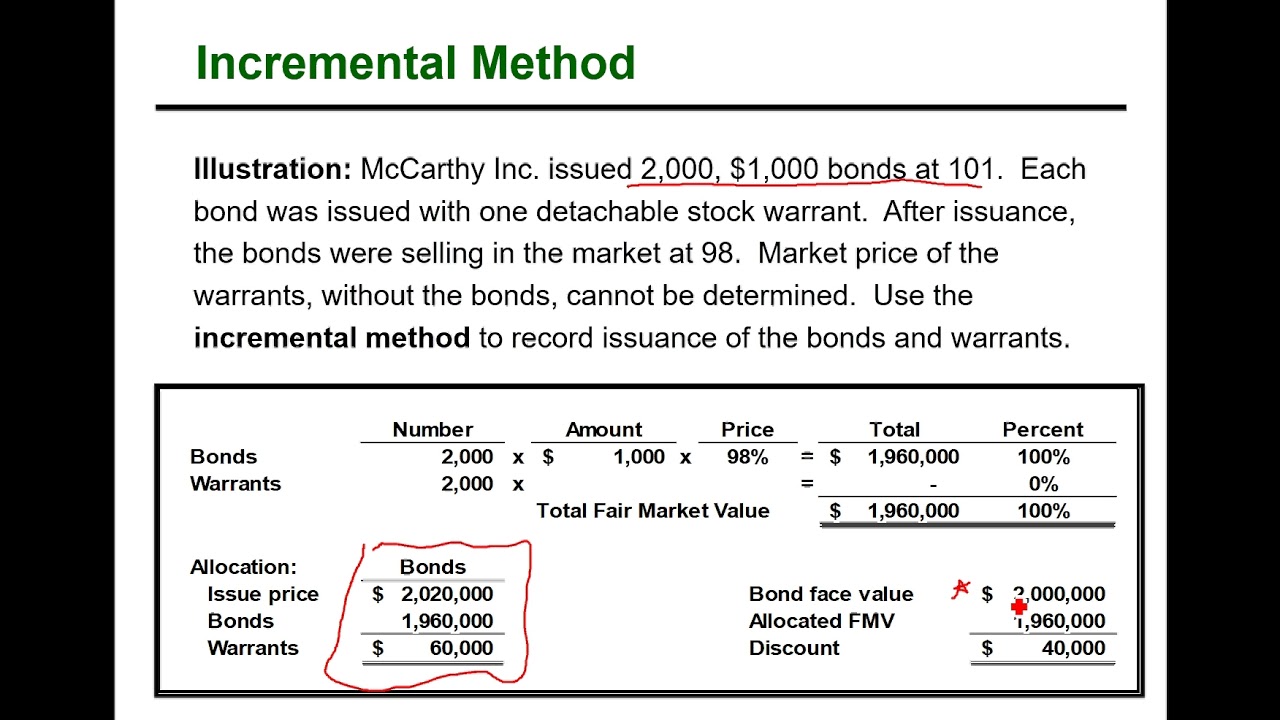

Intermediate Accounting Chapter 16 Stock Warrants Incremental Method

Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share.

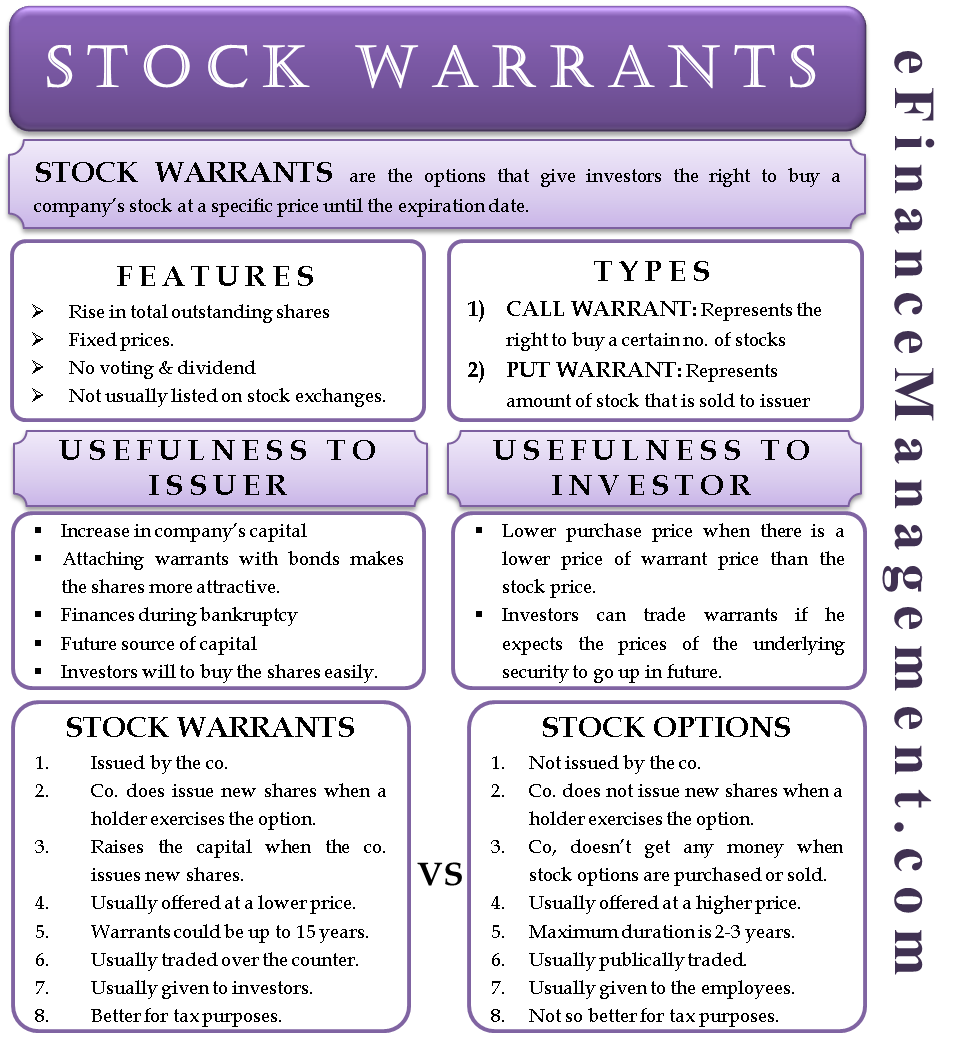

Stock Warrants Features, Types, Benefits, Stock Options And More

Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. Warrants are considered written call options that meet the definition of a derivative. Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors. 4.5/5 (7,359) When the company sells stock.

Accounting for Stock Warrants SuperfastCPA CPA Review

Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. How to account for stock warrants a business may pay a provider of goods or services with stock warrants. The accounting for warrants can either fall. Understanding the accounting and valuation of stock warrants is crucial for both.

How To Account For Stock Warrants A Business May Pay A Provider Of Goods Or Services With Stock Warrants.

4.5/5 (7,359) The accounting for warrants can either fall. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and.

Warrants Are Considered Written Call Options That Meet The Definition Of A Derivative.

Understanding the accounting and valuation of stock warrants is crucial for both corporate finance professionals and investors.