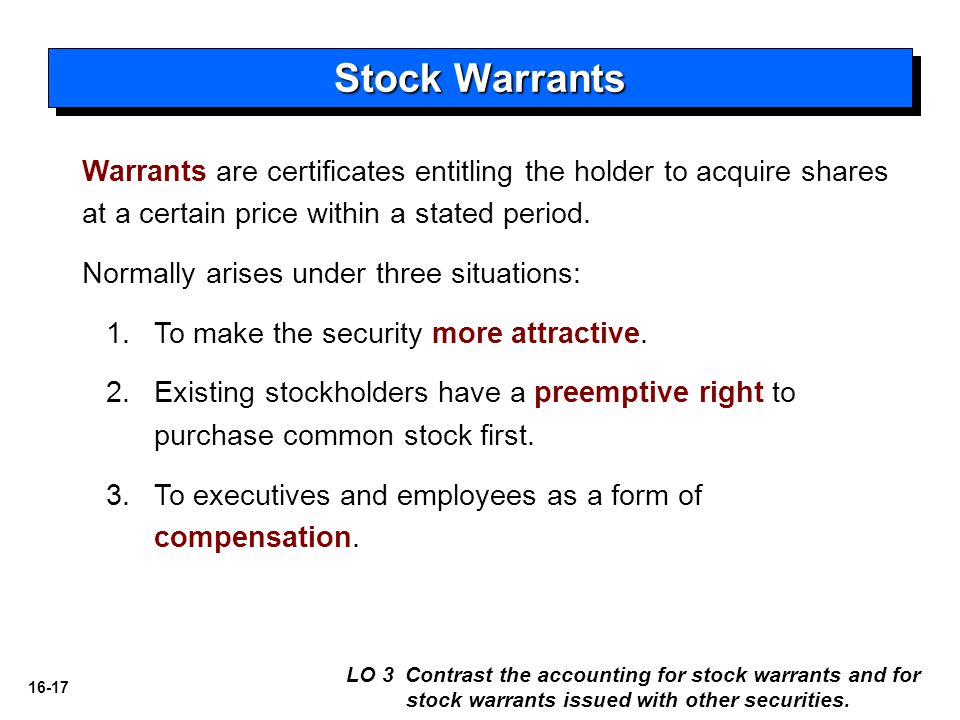

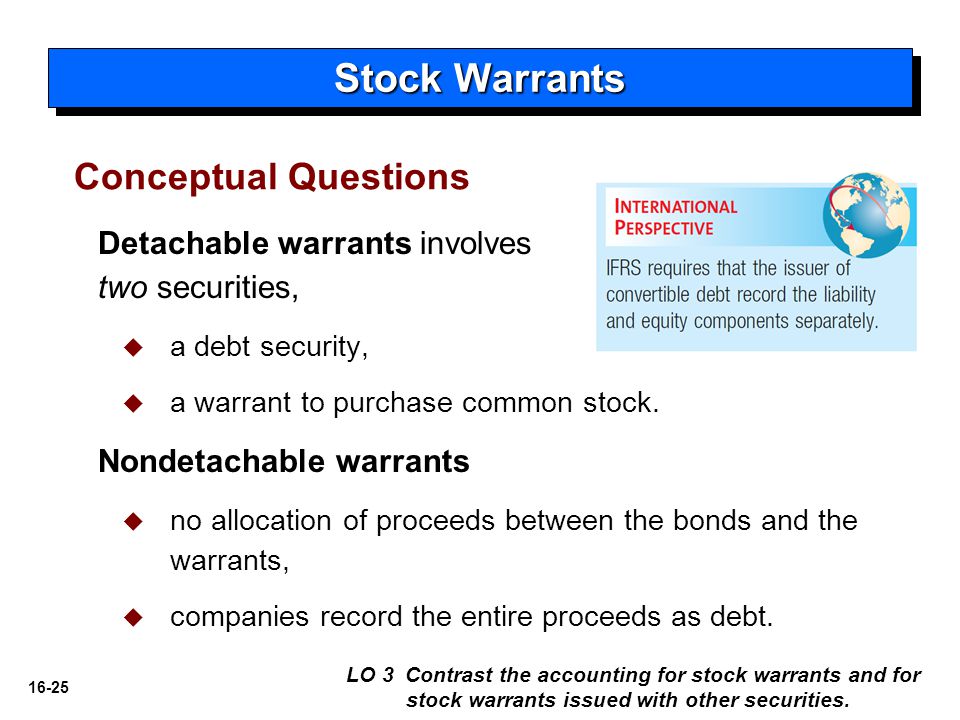

Accounting For Warrants - Explore the intricacies of accounting and valuation of stock warrants, including methods, financial reporting, and tax. See fg 8.4.1 for information on accounting for warrants issued with another instrument. A warrant to sell common or preferred equity is. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued.

Explore the intricacies of accounting and valuation of stock warrants, including methods, financial reporting, and tax. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. See fg 8.4.1 for information on accounting for warrants issued with another instrument. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. A warrant to sell common or preferred equity is.

When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. Explore the intricacies of accounting and valuation of stock warrants, including methods, financial reporting, and tax. See fg 8.4.1 for information on accounting for warrants issued with another instrument. A warrant to sell common or preferred equity is. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and.

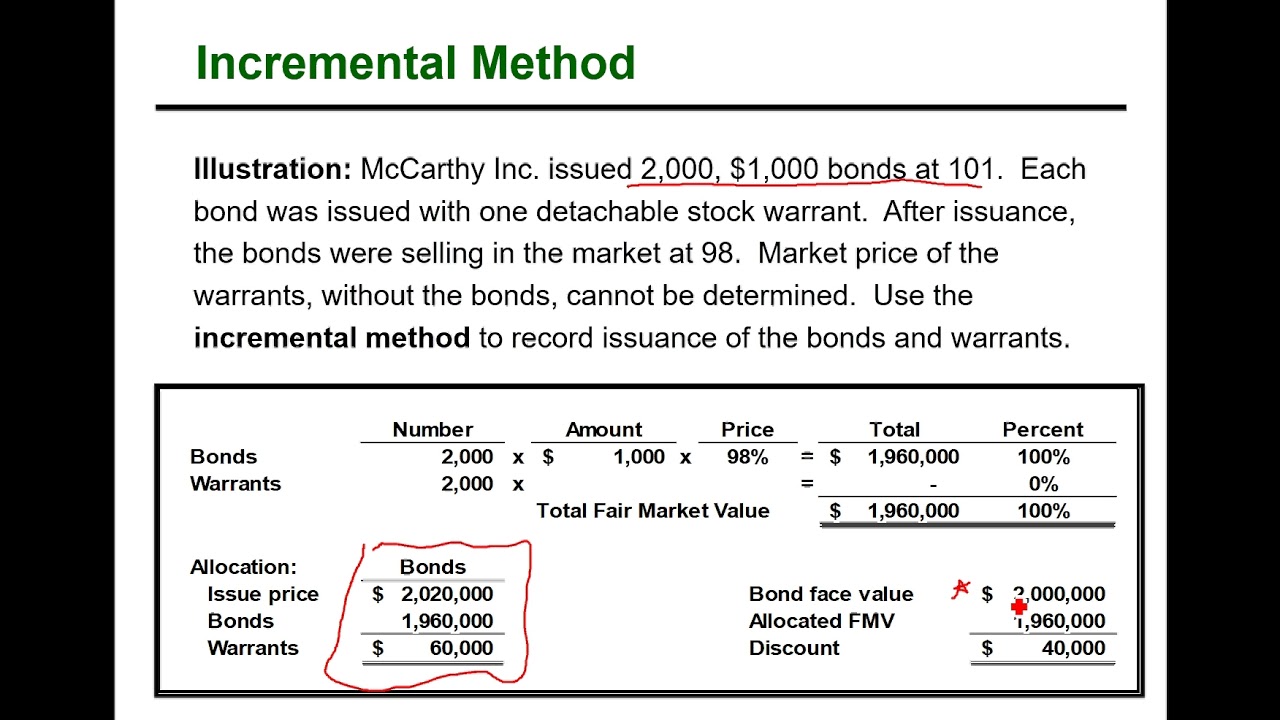

Intermediate Accounting Chapter 16 Stock Warrants Incremental Method

A warrant to sell common or preferred equity is. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. See fg 8.4.1 for information on accounting for warrants issued with another instrument. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued.

Intermediate Accounting ppt download

When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. A warrant to sell common or preferred equity is. See fg 8.4.1 for information on accounting for warrants issued with another instrument. The two main rules to account for stock warrants are that the issuer must.

Accounting for warrants and other instruments issued by SPACs AI

When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. A warrant to sell common or preferred equity is. See fg 8.4.1 for information on accounting for warrants issued with another instrument. Explore the intricacies of accounting and valuation of stock warrants, including methods, financial reporting,.

Intermediate Accounting ppt download

See fg 8.4.1 for information on accounting for warrants issued with another instrument. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. A warrant to sell common or preferred equity is. The two main rules to account for stock warrants are that the issuer must recognize the.

Accounting for Stock Warrants SuperfastCPA CPA Review

Explore the intricacies of accounting and valuation of stock warrants, including methods, financial reporting, and tax. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. A warrant to sell common or preferred equity is. Detachable warrants (or warrants that are deemed to be freestanding instruments (see.

How To Determine Appropriate Accounting Of Warrants In SPAC

When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg.

Intermediate Accounting ppt download

Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. When the company sells stock warrant to the investors, they will receive cash and has.

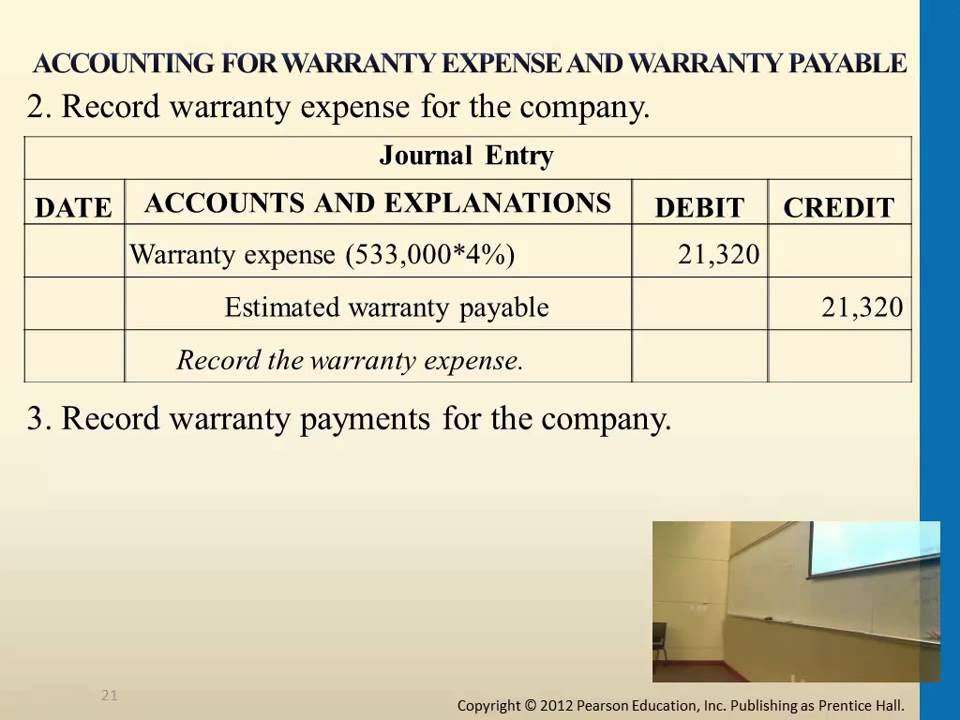

Accounting for Warranty Expense and Warranty Payable YouTube

Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. See fg 8.4.1 for information on accounting for warrants issued with another instrument. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. Explore.

Accounting for Warranties YouTube

See fg 8.4.1 for information on accounting for warrants issued with another instrument. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. A warrant to sell common or preferred equity is. When the company sells stock warrant to the investors, they will receive cash and has the.

Flexgen Trustee Warrants to Checks Resource ppt download

A warrant to sell common or preferred equity is. When the company sells stock warrant to the investors, they will receive cash and has the obligation to sell the share in the future. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. Explore the intricacies of accounting.

When The Company Sells Stock Warrant To The Investors, They Will Receive Cash And Has The Obligation To Sell The Share In The Future.

Explore the intricacies of accounting and valuation of stock warrants, including methods, financial reporting, and tax. Detachable warrants (or warrants that are deemed to be freestanding instruments (see fg 5.3)) issued in a bundled transaction with debt and. See fg 8.4.1 for information on accounting for warrants issued with another instrument. A warrant to sell common or preferred equity is.