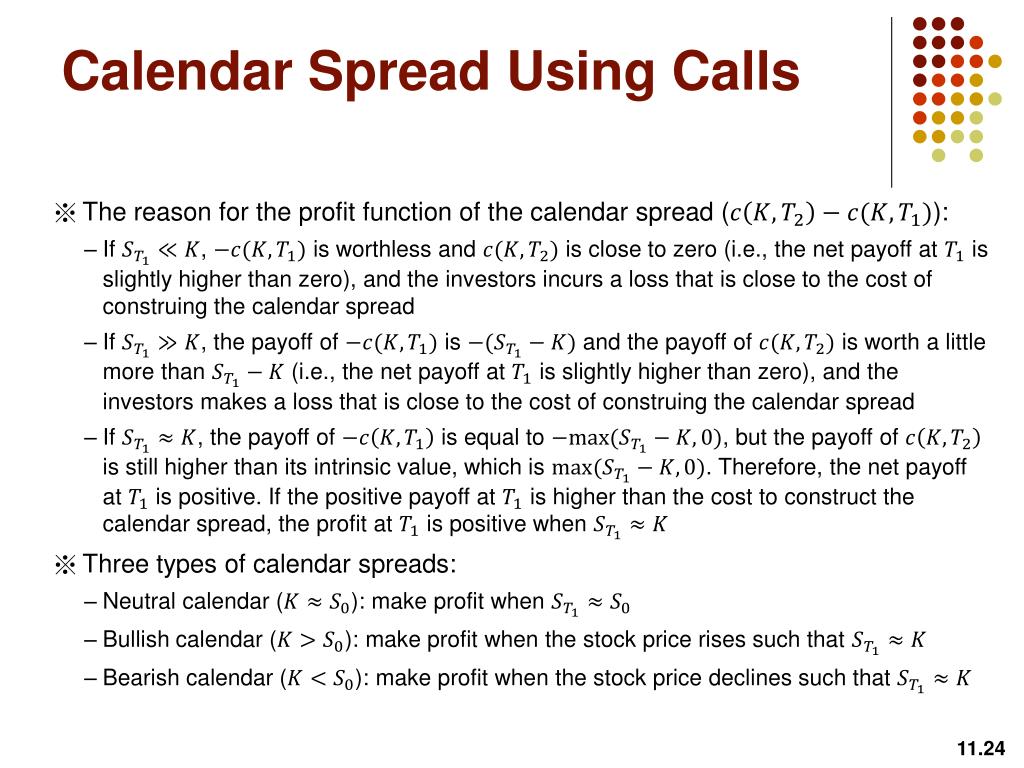

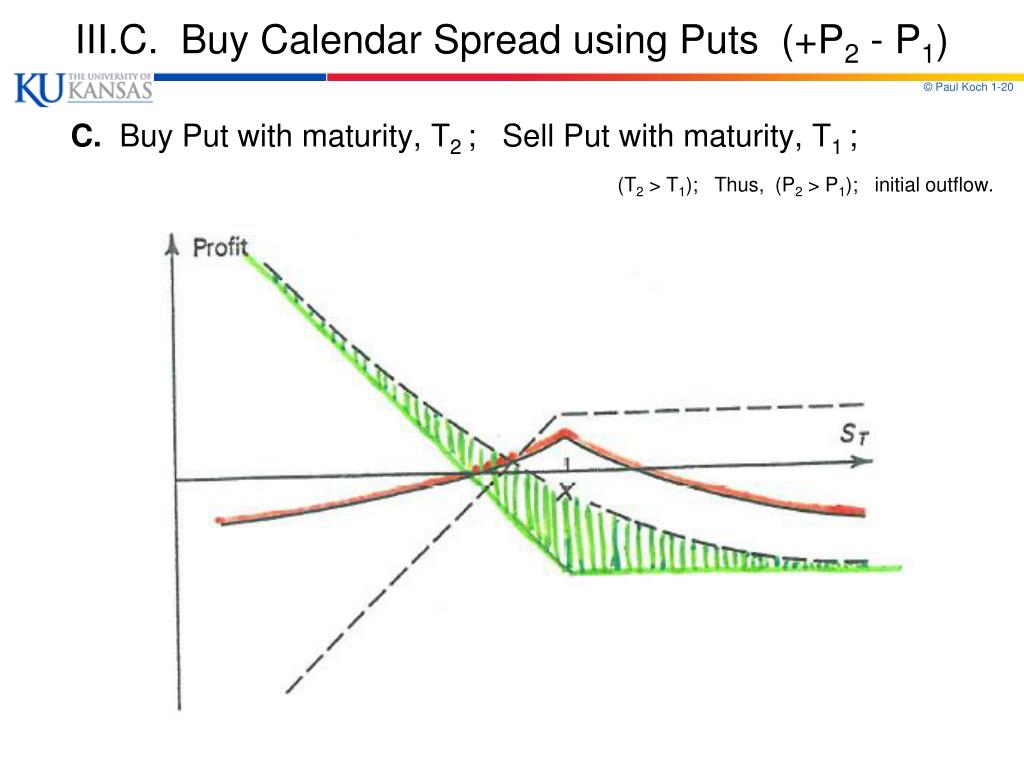

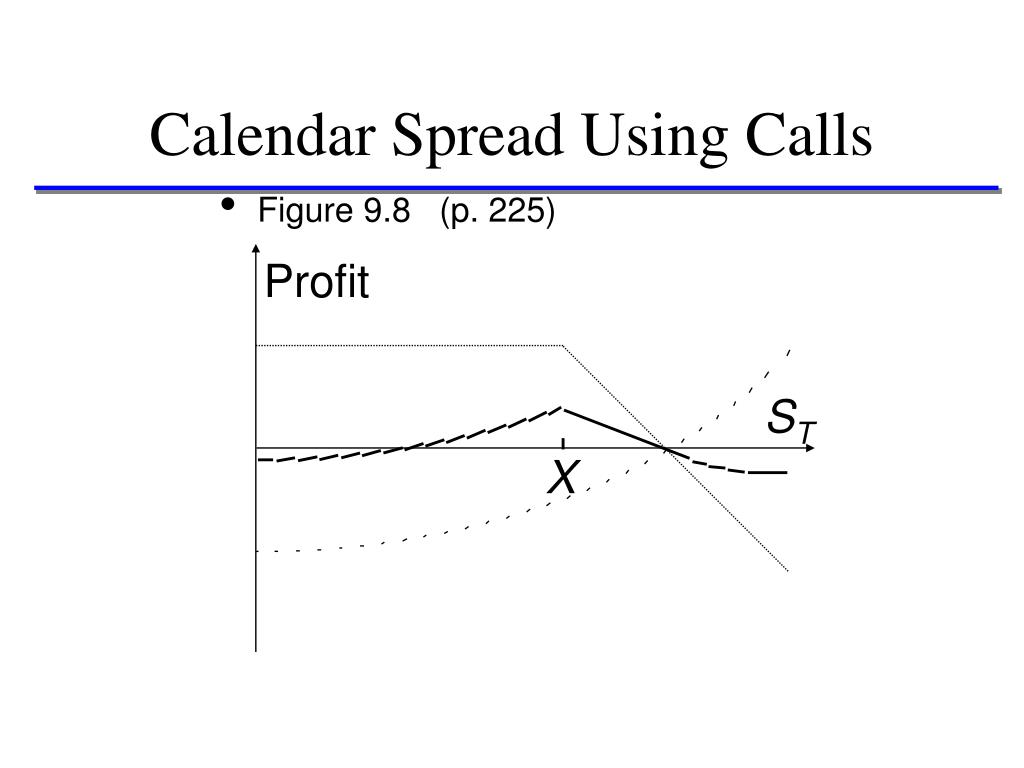

Calendar Spread Using Calls - Calendar spreads allow traders to construct a trade that minimizes the effects of time. Additionally, two variations of each type are possible using call or put options. They are most profitable when the. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. There are two types of calendar spreads:

A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. There are two types of calendar spreads: A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. They are most profitable when the. Additionally, two variations of each type are possible using call or put options. Calendar spreads allow traders to construct a trade that minimizes the effects of time.

Additionally, two variations of each type are possible using call or put options. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. There are two types of calendar spreads: The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. Calendar spreads allow traders to construct a trade that minimizes the effects of time. They are most profitable when the.

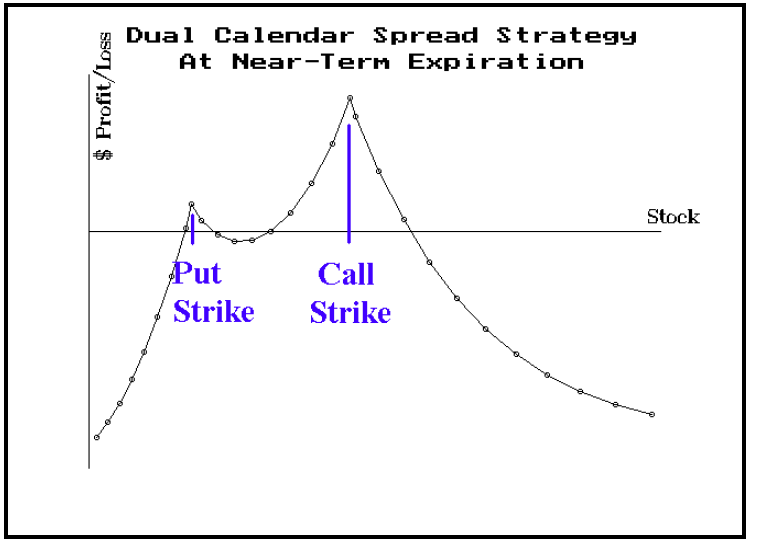

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Calendar spreads allow traders to construct a trade that minimizes the effects of time. Additionally, two variations of each type are possible using call or put options. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. A long calendar spread with calls is.

PPT Trading Strategies Involving Options PowerPoint Presentation

They are most profitable when the. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Additionally, two variations of each type are possible using call or put options. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. There are two.

PPT Chapter 11. Trading Strategies with Options PowerPoint

There are two types of calendar spreads: The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. Additionally, two variations of each type are possible using call or put options. A long calendar spread with calls is the strategy of choice when the forecast.

Chapter 12 Trading Strategies Involving Options ppt download

Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. Additionally, two variations of each type are possible using call or put options. A long calendar call spread.

PPT Trading Strategies Involving Options PowerPoint Presentation

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the.

Trading Guide on Calendar Call Spread AALAP

A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. They are most profitable when the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Additionally, two.

Long Call Calendar Spread Explained (Options Trading Strategies For

The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the.

Credit Spread Options Strategies (Visuals and Examples) projectfinance

A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the.

PPT Trading Strategies Involving Options PowerPoint Presentation

Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. There are two types of calendar spreads: They are most profitable when the. A long calendar spread with calls is.

Long Calendar Spread With Calls Option Strategy Stock Research Tool

Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. A long calendar call spread is seasoned option strategy where you sell and buy same strike price calls.

They Are Most Profitable When The.

There are two types of calendar spreads: The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Additionally, two variations of each type are possible using call or put options.

A Long Calendar Call Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Calls With The Purchased Call Expiring One.

A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the.