Calendar Year Vs - Fiscal year vs calendar year: Many businesses, especially smaller ones with. The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. For individuals, the calendar year typically serves as the basis for personal tax filing. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. A fiscal year can cater to. Should your accounting period be aligned with the regular calendar year, or should you define your own.

Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. A fiscal year can cater to. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. For individuals, the calendar year typically serves as the basis for personal tax filing. The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. Many businesses, especially smaller ones with. Fiscal year vs calendar year: Should your accounting period be aligned with the regular calendar year, or should you define your own.

The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. Fiscal year vs calendar year: Many businesses, especially smaller ones with. A fiscal year can cater to. For individuals, the calendar year typically serves as the basis for personal tax filing. Should your accounting period be aligned with the regular calendar year, or should you define your own. Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. Fiscal year vs calendar year: Many businesses, especially smaller ones with. For individuals, the calendar year typically serves as the basis for personal tax filing. A fiscal year can cater to.

What is the Difference Between Fiscal Year and Calendar Year

The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. Fiscal year vs calendar year: Should your accounting period be aligned with the regular calendar year, or.

Difference Between Fiscal And Calendar Year

For individuals, the calendar year typically serves as the basis for personal tax filing. Fiscal year vs calendar year: Many businesses, especially smaller ones with. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. The calendar year begins on the first of january and ends on 31st december every year, while.

Fiscal Year vs Calendar Year Difference and Comparison

For individuals, the calendar year typically serves as the basis for personal tax filing. Fiscal year vs calendar year: The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. A fiscal year can cater to. Should your accounting period be aligned with the regular calendar.

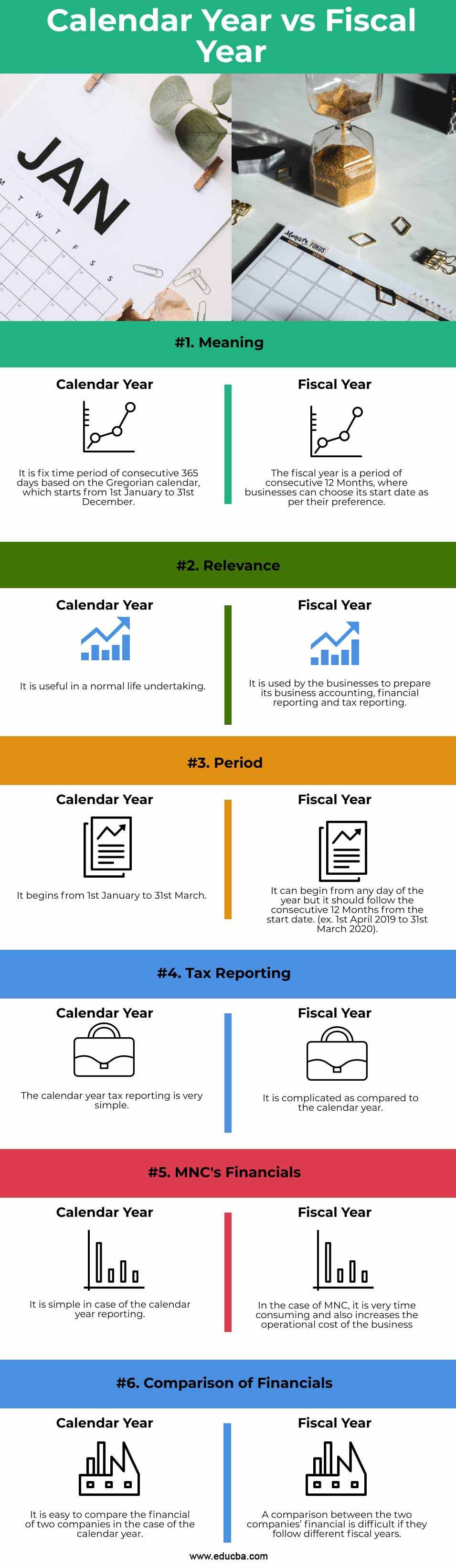

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Many businesses, especially smaller ones with. Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. The primary distinction between a fiscal.

Financial Year Vs Calendar Year Jonis Mahalia

The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. For individuals, the calendar year typically serves as the basis for personal tax filing. A fiscal year can cater to. Fiscal year vs calendar year: The calendar year begins on the first of january and ends on 31st december every year, while.

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

Should your accounting period be aligned with the regular calendar year, or should you define your own. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. For individuals, the calendar year typically serves as the basis for personal tax filing. Fiscal year vs calendar year: Many businesses, especially smaller ones with.

Calendar Year Vs Benefit Year Lisa F. Harris

Fiscal year vs calendar year: Should your accounting period be aligned with the regular calendar year, or should you define your own. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. For individuals, the calendar year typically serves as the basis for personal tax filing. The calendar year begins on the.

This Is The Difference Between Calendar And Financial Year Easy The WFY

The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. A fiscal year can cater to. Fiscal year vs calendar year: Should your accounting period be aligned.

Difference between Fiscal Year and Calendar Year Difference Between

The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. Fiscal year vs calendar year: A fiscal year can cater to. Should your accounting period be aligned.

Many Businesses, Especially Smaller Ones With.

Annually and calendar year both refer to a period of time lasting one year, but there is a slight difference in their usage. The calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day. For individuals, the calendar year typically serves as the basis for personal tax filing. Fiscal year vs calendar year:

Should Your Accounting Period Be Aligned With The Regular Calendar Year, Or Should You Define Your Own.

The primary distinction between a fiscal year and a calendar year lies in the starting and ending dates. A fiscal year can cater to.