Irs Appeal Letter Template - To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. After you determine you meet the criteria for an appeal, (considering an appeal). Below, you’ll find an overview of these two case determinations and how the irs assesses.

After you determine you meet the criteria for an appeal, (considering an appeal). To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. Below, you’ll find an overview of these two case determinations and how the irs assesses.

After you determine you meet the criteria for an appeal, (considering an appeal). To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. Below, you’ll find an overview of these two case determinations and how the irs assesses.

Irs Explanation Letter Samples

After you determine you meet the criteria for an appeal, (considering an appeal). If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. Below, you’ll find an overview of these two case determinations and how the irs assesses.

Tax Appeal Letter Sample SampleTemplatess SampleTemplatess

Below, you’ll find an overview of these two case determinations and how the irs assesses. After you determine you meet the criteria for an appeal, (considering an appeal). If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action.

Free Printable Appeal Letter Templates [Sample PDF] Reconsideration

To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. Below, you’ll find an overview of these two case determinations and how the irs assesses. After you determine you meet the criteria for an appeal, (considering an appeal).

Appeal Letter Templates Pdf Format, Free, Download

To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. After you determine you meet the criteria for an appeal, (considering an appeal). If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. Below, you’ll find an overview of these two case determinations and how the irs assesses.

8 Sample Appeal Letter Template Mous Syusa

Below, you’ll find an overview of these two case determinations and how the irs assesses. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. After you determine you meet the criteria for an appeal, (considering an appeal). To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action.

Irs Appeal Letter Sample SampleTemplatess SampleTemplatess

After you determine you meet the criteria for an appeal, (considering an appeal). If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. Below, you’ll find an overview of these two case determinations and how the irs assesses.

13+ Sample Irs Appeal Letter SineadArchie

After you determine you meet the criteria for an appeal, (considering an appeal). Below, you’ll find an overview of these two case determinations and how the irs assesses. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to.

How To Write An Appeals Letter SampleTemplatess SampleTemplatess

Below, you’ll find an overview of these two case determinations and how the irs assesses. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. After you determine you meet the criteria for an appeal, (considering an appeal). To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action.

Sue Tietz IRS Audit Appeals results letter

To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. After you determine you meet the criteria for an appeal, (considering an appeal). Below, you’ll find an overview of these two case determinations and how the irs assesses.

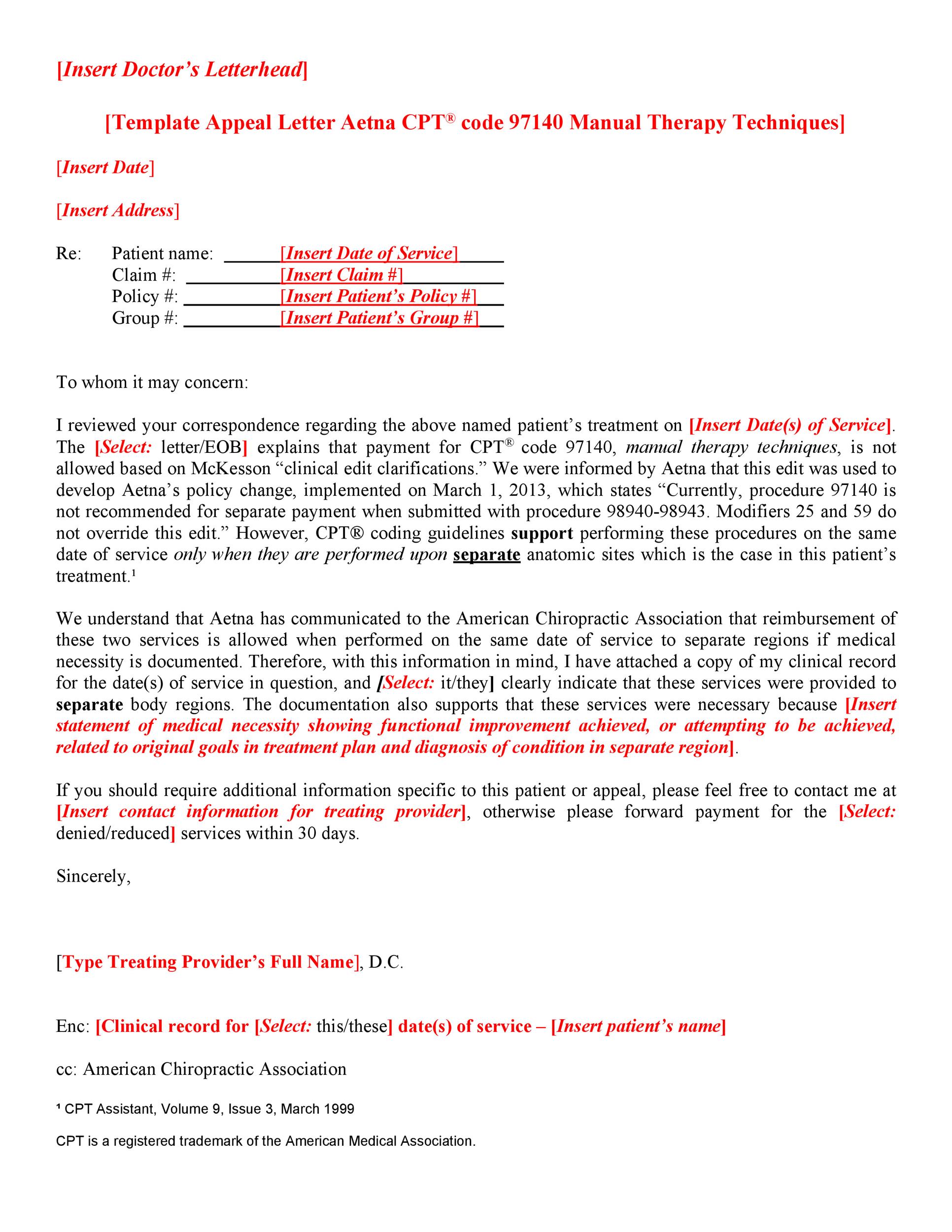

22 Free Appeal Letter Templates (Financial Aid, Employment, College, etc)

After you determine you meet the criteria for an appeal, (considering an appeal). Below, you’ll find an overview of these two case determinations and how the irs assesses. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to.

Below, You’ll Find An Overview Of These Two Case Determinations And How The Irs Assesses.

To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to. After you determine you meet the criteria for an appeal, (considering an appeal).

![Free Printable Appeal Letter Templates [Sample PDF] Reconsideration](https://www.typecalendar.com/wp-content/uploads/2023/05/appeal-letter-financial-aid-sample.jpg)