Valuing Warrants Using Brownian Motion Model - Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. Fractional brownian motion is used to avoid independence on warrant pricing. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Mathematical models are also applied on warrant pricing by. First, based on the ukhov model and the fractional brownian motion, we provide a model to price equity warrants based on the.

Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Mathematical models are also applied on warrant pricing by. Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. Fractional brownian motion is used to avoid independence on warrant pricing. First, based on the ukhov model and the fractional brownian motion, we provide a model to price equity warrants based on the.

Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. First, based on the ukhov model and the fractional brownian motion, we provide a model to price equity warrants based on the. Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. Mathematical models are also applied on warrant pricing by. Fractional brownian motion is used to avoid independence on warrant pricing. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically.

Brownian motion · Comparative Methods

Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. Mathematical models are also applied on warrant pricing by. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has.

Lesson 49 Brownian Motion Introduction to Probability

Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. First, based on the ukhov model and the fractional brownian motion, we provide a model to price equity warrants based on the. Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. Fractional brownian.

(PDF) The valuation of double barrier options under mixed fractional

Fractional brownian motion is used to avoid independence on warrant pricing. First, based on the ukhov model and the fractional brownian motion, we provide a model to price equity warrants based on the. Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. Mathematical models are also applied on warrant pricing by. In this paper,.

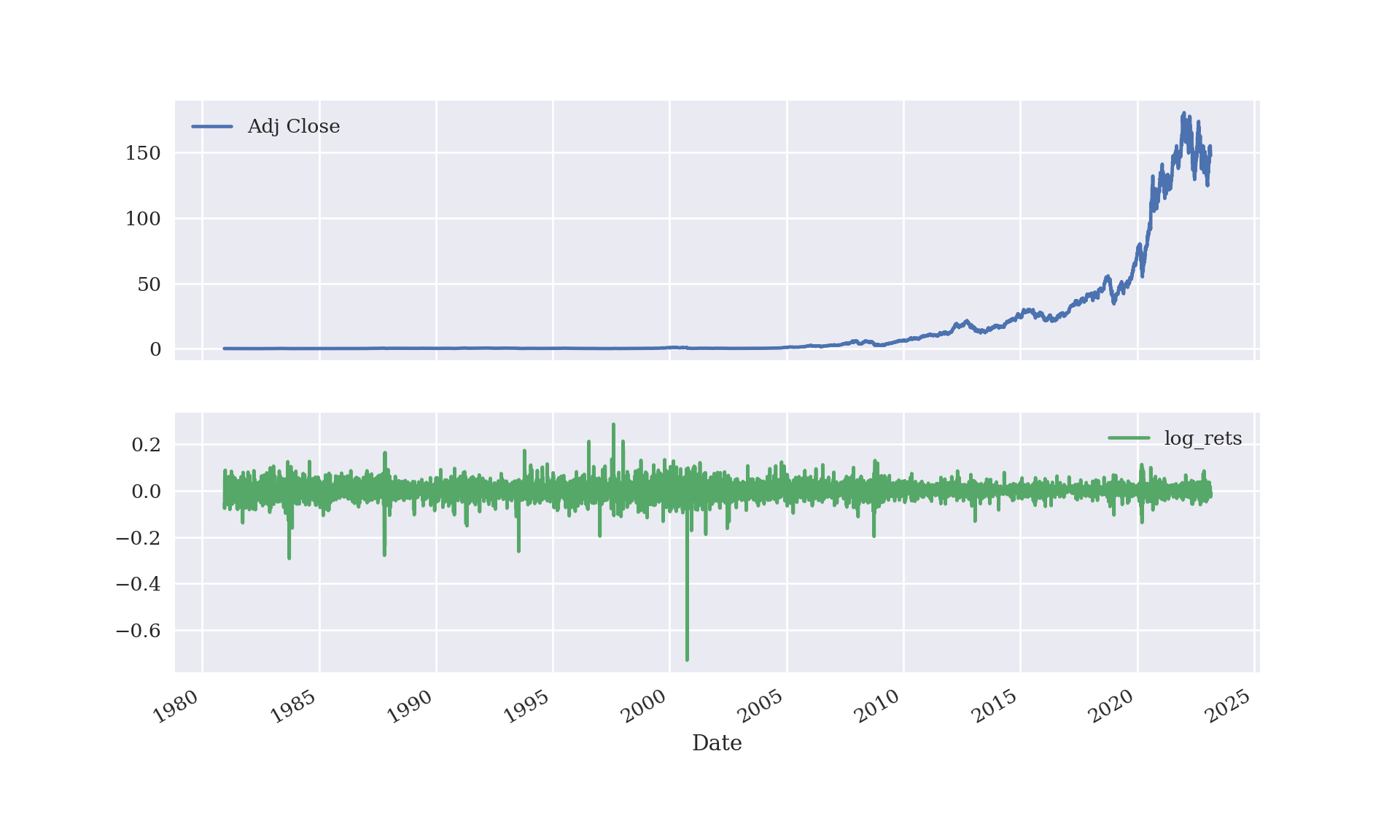

Geometric Brownian Motion in R Quant RL

Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Fractional brownian motion is used to avoid independence on warrant pricing. Valuing warrants using brownian motion models involves applying mathematical.

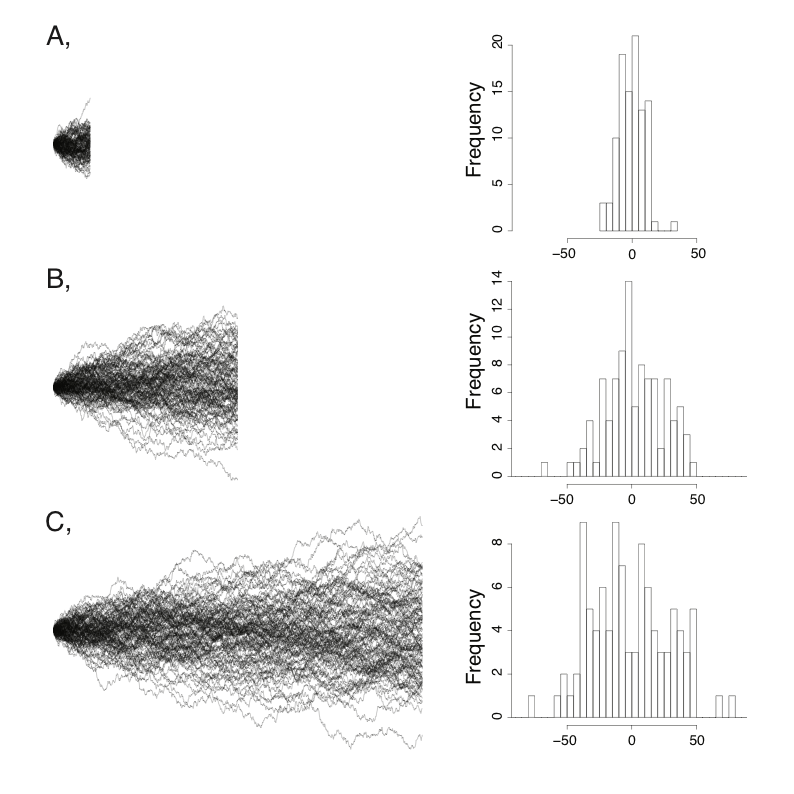

Chapter 4 The geometric Brownian motion model of asset value and Monte

Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. Mathematical models are also applied on warrant pricing by. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has.

Brownian motion 1 (basic properties) YouTube

Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Fractional brownian motion is used to avoid independence on warrant pricing. Mathematical models are also applied on warrant pricing by..

Brownian motion · Comparative Methods

Fractional brownian motion is used to avoid independence on warrant pricing. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. First, based on the ukhov model and the fractional brownian motion, we provide a model.

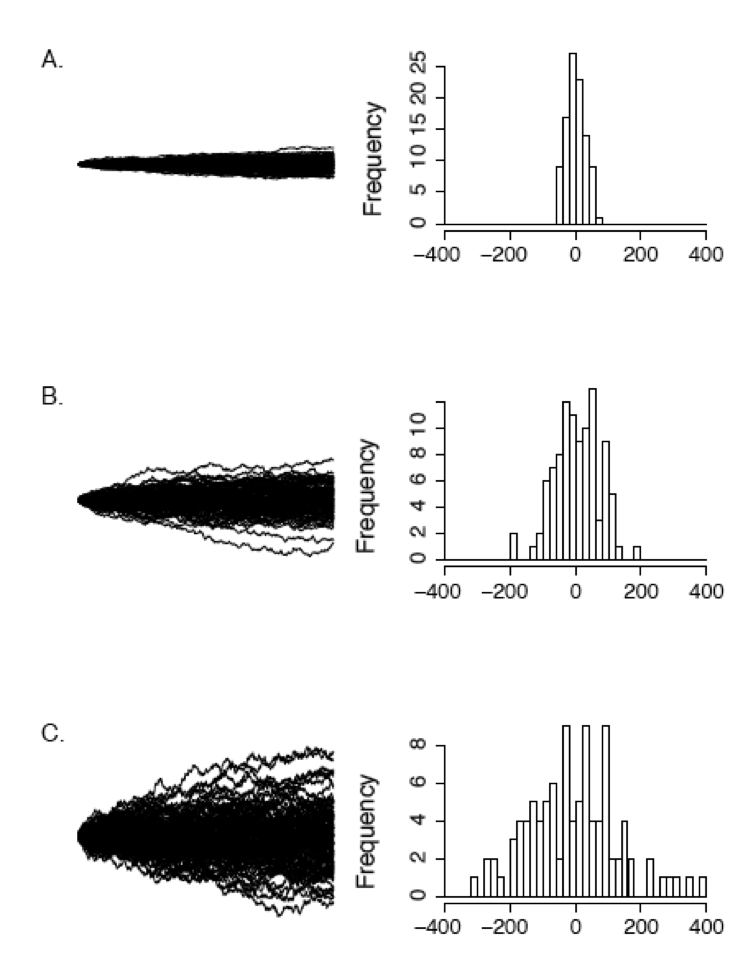

Monte Carlo simulations for the geometric Brownian motion (3) for λ

Fractional brownian motion is used to avoid independence on warrant pricing. Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. First, based on the ukhov model and the fractional brownian motion, we provide a model to price equity warrants based on the. Valuing warrants using brownian motion models.

Table I from The Pricing for Warrant Bonds under Fractional Brownian

In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Mathematical models are also applied on warrant pricing by. Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric. Fractional brownian motion is used to avoid independence on warrant pricing. Valuing warrants using the brownian motion.

Brownian Motion Finance

Valuing warrants using the brownian motion model involves key entities such as the warrant holder, who has the right to exercise. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Mathematical models are also applied on warrant pricing by. Valuing warrants using brownian motion models involves applying mathematical concepts like.

First, Based On The Ukhov Model And The Fractional Brownian Motion, We Provide A Model To Price Equity Warrants Based On The.

Mathematical models are also applied on warrant pricing by. In this paper, the pricing of equity warrants under a class of fractional brownian motion models is investigated numerically. Fractional brownian motion is used to avoid independence on warrant pricing. Valuing warrants using brownian motion models involves applying mathematical concepts like ito's lemma and geometric.